Dezerv

https://dezerv.inAbout

Jobs at Dezerv

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

Dezerv is a wealth management startup founded in 2021 and is co-founded by Sandeep Jethwani, Vaibhav Porwal, and Sahil Contractor. They have led and founded successful wealth management businesses and managed over USD 7 billion in assets. The Dezerv team brings together decades of investing expertise from leading global financial institutions like JP Morgan, UBS, BNP Paribas, etc.

Why are we building Dezerv?

Investing is stressful and emotional. Building & growing wealth is difficult and time-consuming. Most individuals struggle with managing their investments and money. Our goal is to help individuals grow their wealth without the stress, time, and costs involved in a traditional investment. At Dezerv, We are building a platform that leverages our decades of investment expertise to help individuals invest better for their future.

Roles & Responsibilities:

- Facilitate the account opening process (Resident Indians, NRI and Non individuals) and AIF accounts, ensuring a smooth and efficient client onboarding experience.

- KYC: End to end understanding and process towards - registration, modification and validation.

- Understanding of various investment products viz MF, Direct Equity, Bonds, AIF etc.

- Processing various types of transactions (Commercial and non- commercial), of all investment products

- End to end coordination with clients and internal teams to gather required information and documentation for account setup.

- Communication and coordination with various vendors, custodians, and internal departments to address client queries and resolve issues promptly.

- Leverage technology platforms to streamline and automate onboarding processes.

Skills & Experience Required:

- Experience: Minimum 3-7 years of experience in account opening, ideally within PMS or AIF services.

- Platform Experience: Proficiency in Wealth Spectrum is an added advantage.

- Process & Execution Skills: Strong attention to detail, process orientation, and ability to execute tasks efficiently.

- Client Service Orientation: Excellent communication and problem-solving skills for addressing client needs and ensuring a seamless onboarding experience

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

Dezerv is a wealth management startup founded in 2021 and is co-founded by Sandeep Jethwani, Vaibhav Porwal, and Sahil Contractor. They have led and founded successful wealth management businesses and managed over USD 7 billion in assets. The Dezerv team brings together decades of investing expertise from leading global financial institutions like JP Morgan, UBS, BNP Paribas, etc.

Why are we building Dezerv?

Investing is stressful and emotional. Building & growing wealth is difficult and time-consuming. Most individuals struggle with managing their investments and money. Our goal is to help individuals grow their wealth without the stress, time, and costs involved in a traditional investment. At Dezerv, We are building a platform that leverages our decades of investment expertise to help individuals invest better for their future.

Roles & Responsibilities:

- Processing investment transactions in various investment products viz MF, Direct Equity, Bonds, AIF etc.

- Knowledge on NFT (AUM transfer, PMS, AIF, Mutual funds)

- Non financial mutual fund execution with respective AMCs and RTA (Transmission, nominee, signature updation etc)

- Account opening – PMS and AIF (Third Party Products)

- Liaising with clients and internal teams for investments

- Deal with multiple vendors, custodians, and internal departments to answer client queries and resolve issues

- Understanding of tech platforms for automating processes

Skills & Experience Required:

- Experience of around 2-4 years with any AMC or RTA

- Experience in dealing with all securities including Direct Equity, ETFs, Mutual Funds and Bonds.

- Should have a good understanding of products across asset classes

- Strong process orientation & execution skills

- Platform Experience: Proficiency in Wealth Spectrum is an added advantage.

- Process & Execution Skills: Strong attention to detail, process orientation, and ability to execute tasks efficiently.

- Client Service Orientation: Excellent communication and problem-solving skills for addressing client needs and ensuring a seamless onboarding experience.

Similar companies

About the company

We are Hiver. We are a bunch of folks with borderline devotional love for email, committed to the idea of making it noise-free and collaborative for teams. Why email you may ask? Email is one of the most common ways to communicate at work, is far less distracting than its chat counterparts, and lets you respond at your own pace. But it hasn’t evolved over the years to meet the changing collaboration needs of businesses. Teams have to rely on inefficient methods like Forwards and CCs to share information, often leading to messy threads and missed emails. Not to mention the toll it takes on your productivity, ability to concentrate and all things zen. We at Hiver are trying to solve this by giving email collaborative superpowers and, in the process, giving you back the most important currency there is - time.

Jobs

5

About the company

We are Proximity - a global team of coders, designers, product managers, geeks and experts. We solve hard, long-term engineering problems and build cutting edge tech products.

About us

Born in 2019, Proximity Works is a global, fully distributed tech firm headquartered in San Francisco - with hubs across Mumbai, Dubai, Toronto, Stockholm, and Bengaluru. We’re in the business of solving high-stakes engineering challenges with AI-powered solutions tailored for industries like sports, media & entertainment, fintech, and enterprise platforms. From real-time game analytics and ticketing workflows to creative content generation, we help build software that serves millions every day.

About the Founders

At the helm is Hardik Jagda, CEO - a technologist with a startup DNA who brings clarity to complexity and a passion for building delightful experiences.

Milestones & Impact

- Trusted by some of the world’s biggest players - from major media & entertainment giants to one of the world’s largest cricket websites and the second-largest stock exchange in the world.

- Delivered game-changing tech: slashing content creation by 90%, doubling performance metrics for NASDAQ clients, and accelerating speed/performance wins for platforms like Dream11.

Culture & Why It Matters

- Fully distributed and flexible: work 100% remotely, design your own schedule, build habits that work for you and not the other way around.

- People-first culture: Community events, “Proxonaut battles,” monthly off-sites, and a liberal referral policy keep us connected even when we’re apart.

- High-trust environment: autonomy is encouraged. You’re empowered to act, learn fast, and iterate boldly. We know great work comes when talented people have space to think and create.

Jobs

1

About the company

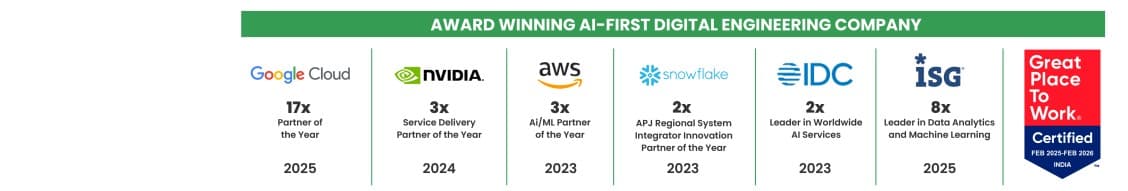

Quantiphi is an award-winning AI-first digital engineering company driven by the desire to reimagine and realize transformational opportunities at the heart of the business. Since its inception in 2013, Quantiphi has solved the toughest and most complex business problems by combining deep industry experience, disciplined cloud, and data-engineering practices, and cutting-edge artificial intelligence research to achieve accelerated and quantifiable business results.

Jobs

4

About the company

OIP Insurtech streamlines insurance operations and optimizes workflows by combining deep industry knowledge with advanced technology. Established in 2012, OIP InsurTech partners with carriers, MGAs, program managers, and TPAs in the US, Canada, and Europe, especially the UK.

With 1,200 professionals serving over 100 clients, we deliver insurance process automation, custom software development, high-quality underwriting services, and skilled tech staff to augment our clients.

While saving time and money is the immediate win, the real game-changer is giving our clients the freedom to grow their books, run their businesses, and focus on what they love. We’re proud to support them on this journey and make a positive impact on the industry!

Jobs

2

About the company

Jobs

10

About the company

Peak Hire Solutions is a leading Recruitment Firm that provides our clients with innovative IT / Non-IT Recruitment Solutions. We pride ourselves on our creativity, quality, and professionalism. Join our team and be a part of shaping the future of Recruitment.

Jobs

237

About the company

Designbyte Studio is a digital design and development studio focused on building clean, modern, and reliable web experiences. We work closely with startups, creators, and growing businesses to design and develop websites, user interfaces, and digital products that are simple, functional, and easy to use.

Our approach is practical and detail-driven. We believe good design should be clear, purposeful, and aligned with real business goals. From concept to launch, we focus on quality, performance, and long-term value.

Jobs

1

About the company

MIC Global is a full-stack digital micro-insurance company on a mission to protect individuals from short-term income loss, anywhere in the world. We focus on embedded parametric micro-insurance solutions designed for micro-entrepreneurs, gig workers, and everyday earners whose financial stability can be disrupted by unexpected events. Our approach delivers simple, relevant, and instant protection—helping people stay on their feet when life takes money out of their pocket.

Through our MiIncome digital reinsurance platform, we partner with platform companies, insurers, and brokers to embed tailored insurance products directly into the ecosystems where people live and work. Backed by underwriting capacity from Lloyd’s Syndicate 5183 and MIC Re in Anguilla, we enable global partners to launch scalable micro-insurance programs that address real, underserved needs. MIC Global is redefining insurance by making it accessible, embedded, and truly fit for the modern workforce.

Jobs

3