Flexmoney Technologies Pvt Ltd

https://flexmoney.inJobs at Flexmoney Technologies Pvt Ltd

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

About Us

Flexmoney’s mission is to “Simplify, Sachet-ize and Democratize Consumer Credit” for the mass-market Indian consumer. Flexmoney enables banks and trusted lending partners to offer lender-branded, instant consumer finance/ EMIs at point of sale. Flexmoney owns and operates InstaCredTM, the largest BNPL network of online merchants and lenders with over 25 M+ pre-approved user credit lines from multiple lending partners and over 3000+ top marquee online merchants.. We provide the technology infrastructure and point-of-sale merchant network distribution as a “plug and play” proposition to banks and NBFCs.

Lending partners can offer lender-branded, frictionless, point of sale purchase credit to any consumer via a “plug and play” integration. Merchants enable our payment mode to provide shoppers with an instant, “cardless” credit payment option at checkout

Job Role & Responsibilities

-

Create/iterate/collaborate design concepts, user flows, sitemaps, interfaces, and visual design systems with the Product Managers and rest of the team members

-

Conduct User and Market Research to understand customer behaviour and related products in the market. Tie that understanding with business objectives to design an intuitive user experience

-

Collaborate with product and engineering teams to define, implement and launch innovative user products across multiple form factors

-

Perform data-driven design iterations to keep improving the business metrics

What we look for

-

3-6 years of experience in the field of UX

-

Experience in working with fidelity based software including Balsamiq, Sketch, and Invision Studio, Marvel App, Figma, Adobe XD, and similar tools.

-

Good understanding of how front-end technologies, patterns for mobile apps &

responsive websites work in the actual scenario

-

Strong communication skills with ability to clearly articulate complex ideas

-

Versatile team player with the ability to work iteratively in a highly agile, lean UX, and scrum environment

-

Understanding of basic front-end languages: HTML5, CSS3 Javascript for rapid prototyping

-

Prior experience in working with tech product companies/ startup is a plus

-

Portfolio of work covering products and services on the web, mobile and desktop

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

About Us

Flexmoney’s mission is to “Simplify, Sachet-ize and Democratize Consumer Credit” for the mass-market Indian consumer. Flexmoney enables banks and trusted lending partners to offer lender-branded, instant consumer finance/ EMIs at the point of sale. Flexmoney owns and operates InstaCredTM, the largest BNPL network of online merchants and lenders with over 25 M+ pre-approved user credit lines from multiple lending partners and over 3000+ top marquee online merchants.. We provide the technology infrastructure and point-of-sale merchant network distribution as a “plug and play” proposition to banks and NBFCs.

Lending partners can offer lender-branded, frictionless, point of sale purchase credit to any consumer via a “plug and play” integration. Merchants enable our payment mode to provide shoppers with an instant, “cardless” credit payment option at checkout

Job Role & Responsibilities

Core Responsibilities:

-

Develop a product roadmap, design wireframes, write requirements, and work in an agile environment to execute on the company vision

-

Understand the various components and drivers of growth, along with trends (such as traffic, conversion, user engagement, and repeat behavior) and create actionable programs leading to user growth

-

Analyze data to identify key leverage points to increase conversion, engagement and retention

Define, understand, and improve key funnels and metrics to measure the success of the product

Additional Responsibilities:

-

Perform market research and sizing along with competitive analysis to define product differentiators and identify potential new business opportunities and areas of growth

-

Collaborate with business, engineering, and other stakeholders to prioritize product backlog and to drive features

What we look for

Experience:

-

Minimum 3 years of experience in Product Management role in a consumer facing role at a consumer internet/ B2C ecommerce company

-

Expertise in driving product growth, driving traffic via internet conversion and digital marketing Skills:

-

Fluent with data analytics

-

Knowledge of how Ads platform and digital marketing works

-

Experience in using product analytics and tracking tools like GA, Clevertap, Mixpanel

-

Excellent analytical, communication, presentation and negotiation skills with cross-functional organizations, customers & stake-holders

-

Self motivated and ownership driven individual

-

Multi-tasker with ability to own and drive multiple product initiatives

-

Ability to influence people and getting things done across any job function.

Similar companies

About the company

To hire better and faster, companies need rich candidate data, smart software and sound human judgement.

Cutshort is using AI to combine all these 3 to offer a 10x talent sourcing solution that is faster, better and cheaper.

We have 3 AI-powered offerings

- Hire using our AI platform: Affordable annual subscriptions

- Get only sourcing: 3.5% of annual CTC when you hire

- Get full recruiting: 6.99% of annual CTC when you hire

Customers such as Fractal, Sprinto, Shiprocket, Highlevel, ThoughtWorks, Deepintent have built strong engineering teams with Cutshort.

Jobs

1

About the company

Project-based businesses transform the world we live in. Deltek innovates and delivers software and solutions that power them to achieve their purpose. Our industry-specific software and information solutions maximize our customers' performance at every stage of the project lifecycle by enabling superior levels of project intelligence, management and collaboration.

Deltek is the recognized global standard for project-based businesses across government contracting and professional services industries, helping more than 30,000 organizations of all sizes deliver on their mission.

With over 4,200 employees worldwide, our team of industry experts is passionately committed to creating exceptional customer experiences.

Jobs

13

About the company

Why Explore a Career at Voiceoc:

1) Be a part of the process of scaling a young startup to a global company.

2) Work directly with co-founders & take up challenging tasks daily that would uplift your own persona.

3) Work on exciting projects of global leading companies

4) Competitive salary & perks.

5) Flexible work schedule & complete ownership of responsibilities.

6) A cool working environment that will make each day at Voiceoc full of fun & new learning.

Jobs

5

About the company

Jobs

0

About the company

At Lynx Technologies LLC, we are redefining how software, AI, and digital products are designed, developed, and scaled. As a next-generation software development and technology partner, we specialize in building cutting-edge digital solutions for ambitious businesses worldwide.

We combine human creativity, AI automation, and advanced technology to empower startups, enterprises, and entrepreneurs to turn their ideas into reality — faster, smarter, and more efficiently than ever.

Whether it's building custom AI-powered platforms, next-gen websites, mobile apps, enterprise-grade software, or scalable digital marketing solutions — Lynx Technologies delivers with precision, innovation, and future-ready designs.

Our mission is simple: We build software for the world of tomorrow.

Jobs

4

About the company

Designbyte Studio is a digital design and development studio focused on building clean, modern, and reliable web experiences. We work closely with startups, creators, and growing businesses to design and develop websites, user interfaces, and digital products that are simple, functional, and easy to use.

Our approach is practical and detail-driven. We believe good design should be clear, purposeful, and aligned with real business goals. From concept to launch, we focus on quality, performance, and long-term value.

Jobs

1

About the company

Upland Software is a global cloud-software company that helps businesses “work smarter” by offering purpose-built, AI-enabled applications that drive revenue, reduce costs and deliver immediate value.

Founded in 2010 and headquartered in Austin, Texas, the company supports thousands of customers across industries—from enterprise to SMB—serving sectors such as manufacturing, retail, government, education, and technology.

Their product portfolio (20+ proven cloud products) spans knowledge-management, content lifecycle automation, digital marketing, project and work management, and contact-centre solutions—all enhanced by embedded AI.

Upland is committed to modern, flexible work—promoting a culture where remote, global teams collaborate and grow together

Jobs

2

About the company

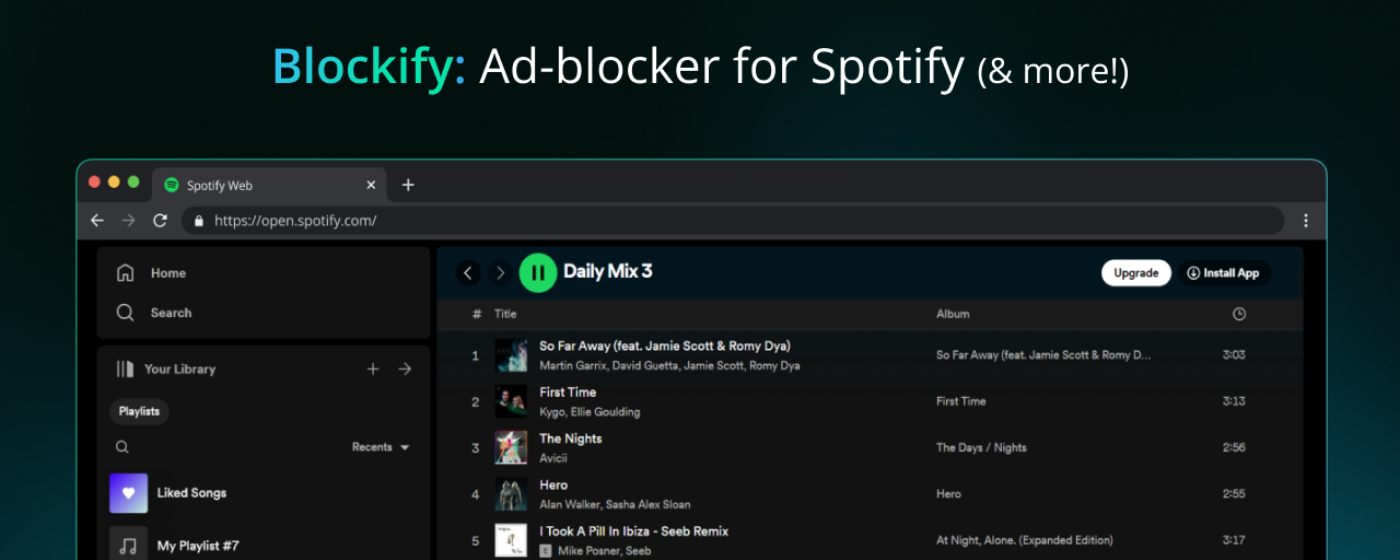

Building the most advanced ad blocker on the planet!🌎

Loved by 3,50,000+ users on Chrome!

Jobs

1

About the company

Jobs

1