Financepeer

https://financepeer.comAbout

Connect with the team

Jobs at Financepeer

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

Similar companies

About the company

Appknox, a leading mobile app security solution HQ in Singapore & Bangalore was founded by Harshit Agarwal and Subho Halder.

Since its inception, Appknox has become one of the go-to security solutions with the most powerful plug-and-play security platform, enabling security researchers, developers, and enterprises to build safe and secure mobile ecosystems using a system-plus human approach.

Appknox offers VA+PT solutions ( Vulnerability Assessment + Penetration Testing ) that provide end-to-end mobile application security and testing strategies to Fortune 500, SMB and Large Enterprises Globally helping businesses and mobile developers make their mobile apps more secure, thus not only enhancing protection for their customers but also for their own brand.

During the course of 9 years, Appknox has scaled up to work with some major brands in India, South-East Asia, Middle-East, Japan, and the US and has also successfully enabled some of the top government agencies with its On-Premise deployments & compliance testing. Appknox helps 500+ Enterprises which includes 20+ Fortune 1000 and ministries/regulators across 10+ countries and some of the top banks across 20+ countries.

A champion of Value SaaS, with its customer and security-first approach Appknox has won many awards and recognitions from G2, and Gartner and is one of the top mobile app security vendors in its 2021 Application security Hype Cycle report.

Our forward-leaning, pioneering spirit is backed by SeedPlus, JFDI Asia, Microsoft Ventures, and Cisco Launchpad and a legacy of expertise that began at the dawn of 2014.

Jobs

7

About the company

As a prominent web development company in India, our core expertise lies in custom software development for web and mobile app development according to client’s need and business workflow. we assist our clients through every step of the way; from consultation, design, development to maintenance. Leave it all in the hands of our expert web developers and we will build you secure, innovative and responsive web applications.

Jobs

20

About the company

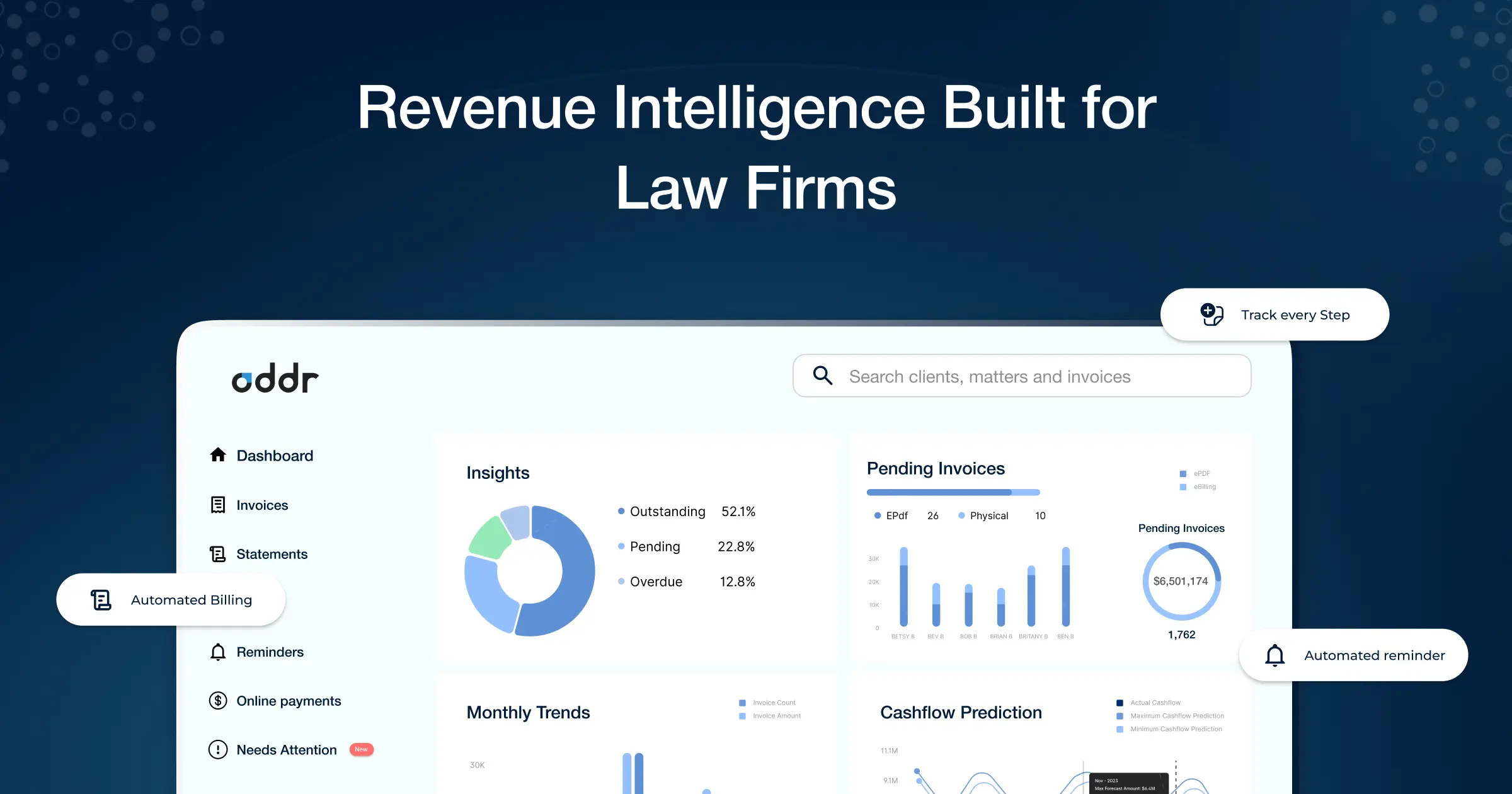

Oddr is the legal industry’s only AI-powered invoice-to-cash platform. Oddr’s AI-powered platform centralizes, streamlines and accelerates every step of billing + collections— from bill preparation and delivery to collections and reconciliation - enabling new possibilities in analytics, forecasting, and client service that eliminate revenue leakage and increase profitability in the billing and collections lifecycle.

www.oddr.com

Jobs

9

About the company

Quantiphi is an award-winning AI-first digital engineering company driven by the desire to reimagine and realize transformational opportunities at the heart of the business. Since its inception in 2013, Quantiphi has solved the toughest and most complex business problems by combining deep industry experience, disciplined cloud, and data-engineering practices, and cutting-edge artificial intelligence research to achieve accelerated and quantifiable business results.

Jobs

5

About the company

Jobs

1

About the company

Stairio is a digital infrastructure company building scalable online systems for modern businesses.

We help service-driven brands establish strong digital foundations through high-performance websites, booking systems, management dashboards, and integrated payment solutions. Our goal is to give businesses ownership, control, and long-term digital assets that generate measurable revenue.

Jobs

2

About the company

Jobs

2

About the company

Jobs

4

About the company

Shopflo is an enterprise technology company providing a specialized checkout infrastructure platform designed to boost conversion rates for direct-to-consumer (D2C) e-commerce brands. Founded in 2021, it focuses on enhancing the online buying experience through fast, customizable, and secure checkout pages that reduce cart abandonment.

We aim to supercharge conversions for e-commerce websites at checkout by improving user experience, helping build stronger intent and trust during the purchase

Problem statement -

(1) There is ~70% drop off at checkout for most independent e-commerce retailer (outside of large marketplaces)

(2) E-commerce cart platforms allow minimal flexibility on checkout, with their experience still same as the last decade

(3) Whereas user experiences are defined by new consumer platforms such as Swiggy, Amazon, etc.

There is a fundamental unbundling of monolith shopping cart platforms globally for mid-market and enterprise customers, who are moving towards headless (read modular) architecture.

Shopflo aims to be the global default for checkout experiences.

Jobs

3