Poonawalla Fincorp

https://poonawallafincorp.comAbout

Jobs at Poonawalla Fincorp

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

Responsibilities :-

1. Design and engineer new next generation fintech solutions.

2. Implement, optimize and manage the microservices based architecture, end to end, considering various technologies and business stakeholders.

3. Build the correct database design and be ready to evolve it as per upcoming requirements.

4. Design, develop and implement various web and mobile app based customer/partner/merchant journeys.

5. Work with multiple stakeholders to understand inherent complexities involved in building the new solutions on top of the existing product and provide the most suitable and optimized one.

6. A go getter with no reservations, should be ready to jump in and code if required.

7. Do code reviews and ensure that best practices are followed

Ensure that best security practices are taken care of while building the product.

Requirements:-

1. Bachelor of Engineering or Bachelor of Technology in Computer Science / Information Technology or a related field

2. At least 12 years of experience that includes at least 5 years of experience in technology architecture with a significant focus on building scalable full stack applications to be deployed on cloud

3. Excellent problem solving and strategic thinking and leadership skills with the ability to implement complex projects to successful completion

4. Hands on experience in Nodejs, JavaScript, Mongo DB, Relational Database and React. Must be efficient in building efficient code and DB queries.

5. Experience in using cloud services from various cloud providers i.e. AWS, Azure, OCI (AWS exposure is the must)

6. Understanding and experience in ensuring the security best practices are taken care of while building the product.

Should have excellent communication and interpersonal skills.

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

Job Profile:-

- Appraising credit proposals and scrutinizing relevant documents prior to sanctioning and disbursement of pre owned car and ensuring compliance with organizational policies.

- Conducting comprehensive study of creditworthiness of individual clients by supervising data verification and field investigation activities.

- Evaluating financial statements of various clients and availing approval of quantum of credit considering all deviations as per policy.

- Interacting with the Field investigation FI and Risk Control Unit RCU agencies, visiting them regularly to resolve their queries, providing valuable feedback to enhance their report quality and ensure seamless execution of business operations.

- Conducted surprise visits to some customers to cross check the authenticity of the FI and RCU reports in turn avoiding fraud cases and minimizing the loses.

- Successfully maintained a Login to disbursement turn around time of 7days and a loan processing turn around time of 48 hours inclusive of FI and RCU process completion

- Pivotal in achieving minimal number of operational errors related to files disbursed.

- Implementing various trackers and reporting systems, preparing daily MIS and monthly branch reports for monitoring business performance.

- Successfully improved the branch profitability by constantly supervising the operations costs.

- Mentoring & motivating the CPA team force, imparting continuous on job training on various changes in the policy for accomplishing greater operational effectiveness.

- Conducting programmes to enhance efficiency in various business operations, setting up sales objectives and streamlining processes to ensure smooth functioning of sales and credit operations.

- Channel Management-Supervising management of files logged in through the alternate Channel as this is one of the most profit making product for the company.

- Implementing result oriented recovery plans, made Business development visits mandatory for high value disbursement rendering regular feedback to the collections team on portfolio performance

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

Job Profile:-

- Appraising credit proposals and scrutinizing relevant documents prior to sanctioning and disbursement of pre owned car and ensuring compliance with organizational policies.

- Conducting comprehensive study of creditworthiness of individual clients by supervising data verification and field investigation activities.

- Evaluating financial statements of various clients and availing approval of quantum of credit considering all deviations as per policy.

- Interacting with the Field investigation FI and Risk Control Unit RCU agencies, visiting them regularly to resolve their queries, providing valuable feedback to enhance their report quality and ensure seamless execution of business operations.

- Conducted surprise visits to some customers to cross check the authenticity of the FI and RCU reports in turn avoiding fraud cases and minimizing the loses.

- Successfully maintained a Login to disbursement turn around time of 7days and a loan processing turn around time of 48 hours inclusive of FI and RCU process completion

- Pivotal in achieving minimal number of operational errors related to files disbursed.

- Implementing various trackers and reporting systems, preparing daily MIS and monthly branch reports for monitoring business performance.

- Successfully improved the branch profitability by constantly supervising the operations costs.

- Mentoring & motivating the CPA team force, imparting continuous on job training on various changes in the policy for accomplishing greater operational effectiveness.

- Conducting programmes to enhance efficiency in various business operations, setting up sales objectives and streamlining processes to ensure smooth functioning of sales and credit operations.

- Channel Management-Supervising management of files logged in through the alternate Channel as this is one of the most profit making product for the company.

- Implementing result oriented recovery plans, made Business development visits mandatory for high value disbursement rendering regular feedback to the collections team on portfolio performance

Similar companies

About the company

Deep Tech Startup Focusing on Autonomy and Intelligence for Unmanned Systems. Guidance and Navigation, AI-ML, Computer Vision, Information Fusion, LLMs, Generative AI, Remote Sensing

Jobs

5

About the company

Jobs

2

About the company

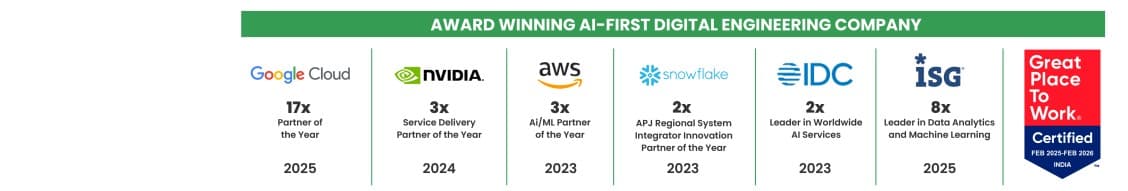

Quantiphi is an award-winning AI-first digital engineering company driven by the desire to reimagine and realize transformational opportunities at the heart of the business. Since its inception in 2013, Quantiphi has solved the toughest and most complex business problems by combining deep industry experience, disciplined cloud, and data-engineering practices, and cutting-edge artificial intelligence research to achieve accelerated and quantifiable business results.

Jobs

4

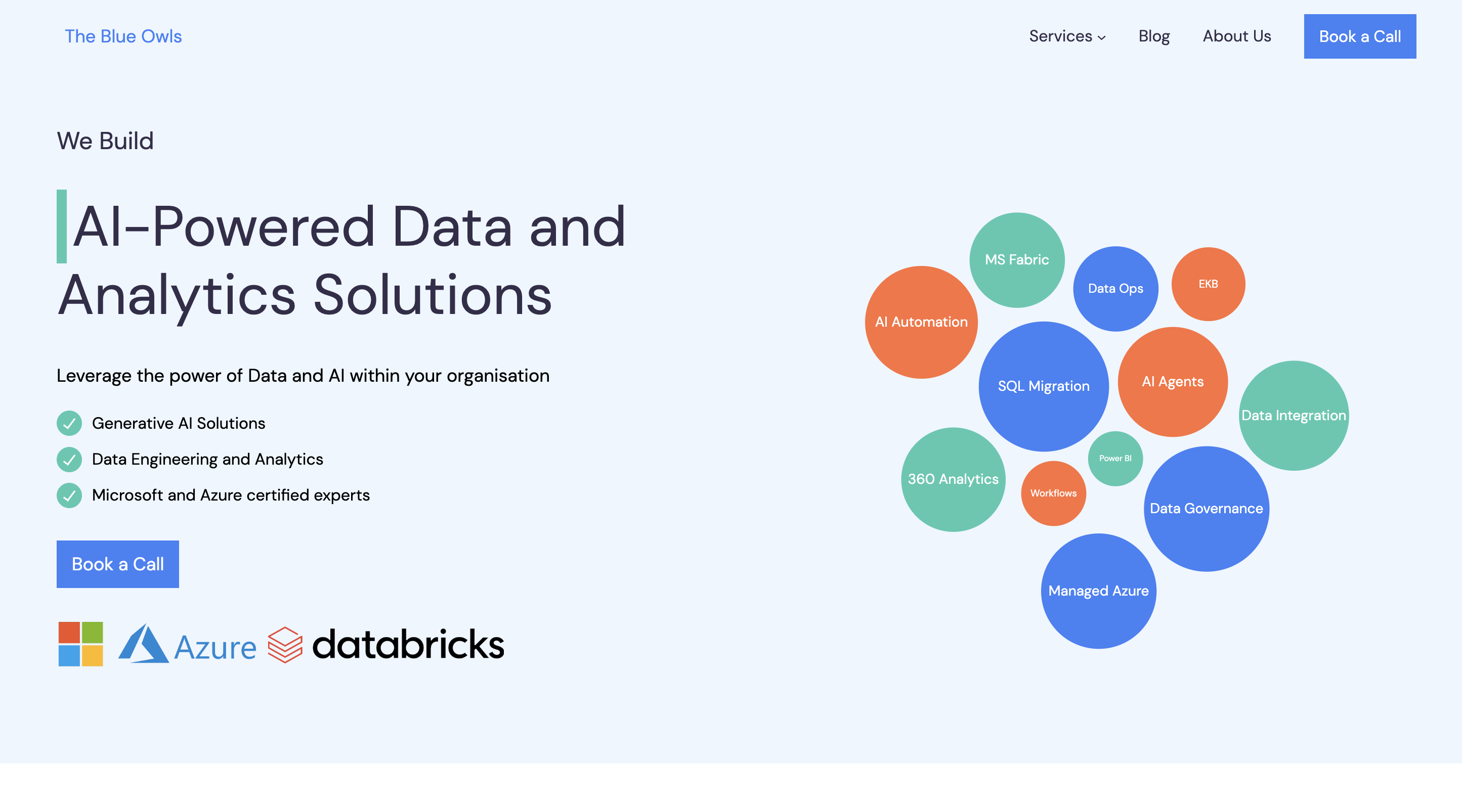

About the company

At TheBlueOwls, we are passionate about harnessing the power of data analytics and artificial intelligence to transform businesses and drive innovation. With a team of experts and cutting-edge technology, we help our clients unlock valuable insights from their data and leverage AI solutions to stay ahead in today's competitive landscape.

Our Founder

Our company was founded by Puran Ticku, an ex-Microsoft Architect with over 20+ years of experience in the field of data and digital health. Puran Ticku has a deep understanding of the potential of data analytics and AI and has successfully led transformative solutions for numerous organizations.

Our Expertise

We specialize in providing comprehensive data analytics services, helping businesses make data-driven decisions and uncover hidden patterns and trends. With our advanced AI capabilities, we enable our clients to automate processes, enhance productivity, and gain a competitive edge in their industries.

Our Approach

At TheBlueOwls, we believe that the key to successful data analytics and AI implementation lies in a holistic approach. We work closely with our clients to understand their unique challenges and goals, and tailor our solutions to meet their specific needs. Our team of skilled professionals utilizes state-of-the-art technology and industry best practices to deliver exceptional results.

Our Commitment

We are committed to delivering the highest level of quality and value to our clients. We strive for excellence in every project we undertake, ensuring that our solutions are not only effective, but also scalable and sustainable. With our deep domain expertise and customer-centric approach, we are dedicated to driving success for our clients and helping them achieve their business objectives.

Contact us today to learn more about how TheBlueOwls can empower your organization with data analytics and AI solutions that drive growth and innovation.

Jobs

4

About the company

Jobs

14

About the company

Peak Hire Solutions is a leading Recruitment Firm that provides our clients with innovative IT / Non-IT Recruitment Solutions. We pride ourselves on our creativity, quality, and professionalism. Join our team and be a part of shaping the future of Recruitment.

Jobs

258

About the company

Jobs

2

About the company

Jobs

1

About the company

Crea8 (www.crea8.co.in) helps you find skincare from top brands that actually works for your skinconcerns, lifestyle and goals. We decode ingredients to help you understand what’s in your product and guide you through the good, bad and ugly. Our mission is to make personal care more personal, simple and honest for everyone.

Jobs

1