Loanzen

https://loanzen.inAbout

Connect with the team

Jobs at Loanzen

No jobs found

Similar companies

About the company

Appknox, a leading mobile app security solution HQ in Singapore & Bangalore was founded by Harshit Agarwal and Subho Halder.

Since its inception, Appknox has become one of the go-to security solutions with the most powerful plug-and-play security platform, enabling security researchers, developers, and enterprises to build safe and secure mobile ecosystems using a system-plus human approach.

Appknox offers VA+PT solutions ( Vulnerability Assessment + Penetration Testing ) that provide end-to-end mobile application security and testing strategies to Fortune 500, SMB and Large Enterprises Globally helping businesses and mobile developers make their mobile apps more secure, thus not only enhancing protection for their customers but also for their own brand.

During the course of 9 years, Appknox has scaled up to work with some major brands in India, South-East Asia, Middle-East, Japan, and the US and has also successfully enabled some of the top government agencies with its On-Premise deployments & compliance testing. Appknox helps 500+ Enterprises which includes 20+ Fortune 1000 and ministries/regulators across 10+ countries and some of the top banks across 20+ countries.

A champion of Value SaaS, with its customer and security-first approach Appknox has won many awards and recognitions from G2, and Gartner and is one of the top mobile app security vendors in its 2021 Application security Hype Cycle report.

Our forward-leaning, pioneering spirit is backed by SeedPlus, JFDI Asia, Microsoft Ventures, and Cisco Launchpad and a legacy of expertise that began at the dawn of 2014.

Jobs

9

About the company

Deep Tech Startup Focusing on Autonomy and Intelligence for Unmanned Systems. Guidance and Navigation, AI-ML, Computer Vision, Information Fusion, LLMs, Generative AI, Remote Sensing

Jobs

4

About the company

Jobs

1

About the company

Quantiphi is an award-winning AI-first digital engineering company driven by the desire to reimagine and realize transformational opportunities at the heart of the business. Since its inception in 2013, Quantiphi has solved the toughest and most complex business problems by combining deep industry experience, disciplined cloud, and data-engineering practices, and cutting-edge artificial intelligence research to achieve accelerated and quantifiable business results.

Jobs

5

About the company

Sun King is a leading global provider of off-grid solar energy solutions, designed to serve the 1.8 billion people who lack reliable or affordable access to traditional electrical grids. With a mission to power brighter lives, the company focuses on underserved markets across Africa and Asia. Sun King's product range includes solar lanterns, solar home systems, and solar inverters, tailored to meet a variety of energy needs—from portable lighting to powering entire homes.

The company's innovative solutions, such as the recently launched PowerHub 3300 and expandable solar home systems, reflect their commitment to evolving customer demands. With operations in over 40 countries and millions of products sold, Sun King makes solar energy accessible through pay-as-you-go financing options. The company’s network of field agents plays a key role in selling, installing, and servicing products, driving local economic development. Rooted in sustainability, Sun King also implements a Sustainable Financing Framework and ensures customer satisfaction through extensive service centers and after-sales support.

Jobs

0

About the company

Sim Gems Group is a leading diamond manufacturer, miner, wholesaler, and distributor of natural diamonds. Established in 1993, the company is dedicated to providing customers with cut and polished stones of the highest quality and unmatched brilliance. They focus on ethical sourcing, following the Kimberley Process Certification Scheme, and prioritize sustainable practices in their operations.

Jobs

3

About the company

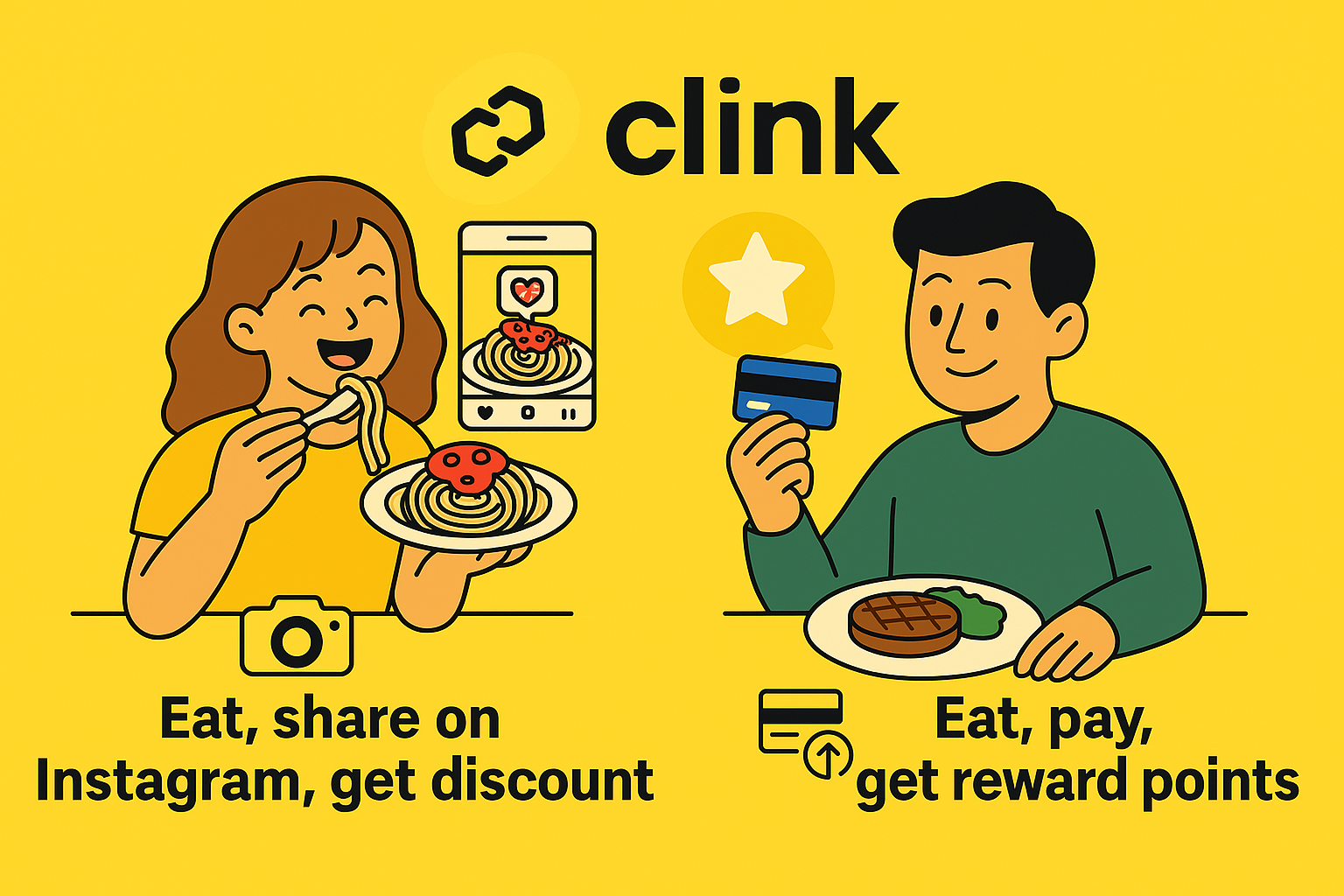

Clink is reimagining restaurant growth — no commissions, no food bloggers, just AI-powered loyalty and real customer influence.

Our platform helps restaurants turn diners into repeat customers and brand advocates using smart rewards and Instagram-powered virality. With every visit, customers earn personalized rewards and post about their experience on instagram driving organic traffic, not paid ads.

If you're excited by AI, social growth, and building the future of hospitality tech — Clink is the place to be.

Jobs

1

About the company

Peak Hire Solutions is a leading Recruitment Firm that provides our clients with innovative IT / Non-IT Recruitment Solutions. We pride ourselves on our creativity, quality, and professionalism. Join our team and be a part of shaping the future of Recruitment.

Jobs

242

About the company

Mojo Web Technology | Facebook Application Development | SAAS Products | Best Developers

Jobs

3