Minions Ventures

https://kredx.comAbout

Connect with the team

Jobs at Minions Ventures

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

Product Manager

Job Description :

- Develop and define product roadmaps and feature concepts

- Work with engineering, design, marketing, business sales, and QA team to come up with time estimates and adhering to external commitments

- Identify new products, gather requirements, build and ship new products.

- Scope and prioritize activities based on business and customer impact

- Talk regularly with our customers and improve the product based on the feedback

- Define and continuously analyze metrics for the success of the product

- Be familiar with industry best practices for product management and explore improving processes at KredX

- Engage with multiple stakeholders within the organization

- Identifying all barriers to feature adoption (awareness, legal, regulatory, training, customer usage) and ensuring systematic elimination of the same

- Manage project delivery to ensure timely product launches

- Identify and unblock short term issues and hurdles while always keeping eyes on the long term prize

Requirements :

- 3+ years of product management experience

- First-principle thinking

- Prior experience in working on web and mobile apps

- Relentless focus on customer experience

- Ability to pull data using basic SQL queries and ask the right questions of data

- Ability to hack solutions using low-code / no-code approaches (like Zapier, Zoho Creator, AWS Honeycode, or any of such 100s of tools etc..)

- Keen interest in financial and investment landscape of India

- Prior experience in Fintech or Finance/Investment domain is a plus but not mandatory

The recruiter has not been active on this job recently. You may apply but please expect a delayed response.

JD – Engineering Manager Role

Responsibilities:

- Designed, developed and deployed cloud-native applications (we use AWS)

- Working on or leading enterprise tech products and worked with enterprise customers

- Mentor & grow / Hire Engineering Managers to lead up these individual units.

- Work closely with Product Management, Business Development and Operations team and enable them by providing scalable and high quality technology solutions at a rapid pace.

- Set up the organisation & processes to enable timely delivery of projects with high quality.

- Set up best practices for development and champion their adoption.

- Well versed in Software Architecture and Design - You should be able to spot flaws in the existing architecture and design. You would help us refactor and re-architecture the code for easier and faster development.

- Oversee Architecture & design of technically robust, flexible and scalable solutions.

- Perform well in uncertainties and collaborate and work with unclear interfaces to other teams in our rapidly evolving organisations.

- Create clear career paths for team members and help them grow with regular & deep mentoring.

- Identify, define, and coordinate the training needs of the team.

- Perform regular performance evaluation and share and seek feedback on a regular basis

- Building and maintaining data capabilities at KredX while taking care of scaling, privacy and processing aspects.

- Ability to work with external partners and vendors to integrate with KredX product

- Write blogs and other technical papers to share the lessons with community both inside and outside the company and or participates in technical events to get new knowledge to the organisation while improving brand of engineering team at KredX

- Appropriately escalate any issues/concerns that require immediate attention from other affected parties

- Always be thinking about the engineering systems and business from different angles - fraud, downtimes, scale, business direction and more

Requirements:

- Experience in working with large scale unstructured data, and data science

- Deep Understanding of enterprise grade technologies.

- Deep understanding & expertise with highly transactional, large relational and complex systems.

- Strong leadership skills.

- Possess superb troubleshooting and problem analysis skills.

- Knowledgeable about new engineering paradigms and developments in software engineering

Similar companies

About the company

We are Proximity - a global team of coders, designers, product managers, geeks and experts. We solve hard, long-term engineering problems and build cutting edge tech products.

About us

Born in 2019, Proximity Works is a global, fully distributed tech firm headquartered in San Francisco - with hubs across Mumbai, Dubai, Toronto, Stockholm, and Bengaluru. We’re in the business of solving high-stakes engineering challenges with AI-powered solutions tailored for industries like sports, media & entertainment, fintech, and enterprise platforms. From real-time game analytics and ticketing workflows to creative content generation, we help build software that serves millions every day.

About the Founders

At the helm is Hardik Jagda, CEO - a technologist with a startup DNA who brings clarity to complexity and a passion for building delightful experiences.

Milestones & Impact

- Trusted by some of the world’s biggest players - from major media & entertainment giants to one of the world’s largest cricket websites and the second-largest stock exchange in the world.

- Delivered game-changing tech: slashing content creation by 90%, doubling performance metrics for NASDAQ clients, and accelerating speed/performance wins for platforms like Dream11.

Culture & Why It Matters

- Fully distributed and flexible: work 100% remotely, design your own schedule, build habits that work for you and not the other way around.

- People-first culture: Community events, “Proxonaut battles,” monthly off-sites, and a liberal referral policy keep us connected even when we’re apart.

- High-trust environment: autonomy is encouraged. You’re empowered to act, learn fast, and iterate boldly. We know great work comes when talented people have space to think and create.

Jobs

3

About the company

Optimo Capital is a newly established NBFC with a mission to serve the underserved MSME businesses with their credit needs in India. Less than 15% of MSMEs have access to formal credit. We aim to bridge this credit gap by employing a phygital model (physical branches + digital decision-making).

Being a technology and data-first company, tech and data enthusiasts play a crucial role in building the tech & infra to help the company thrive.

Jobs

1

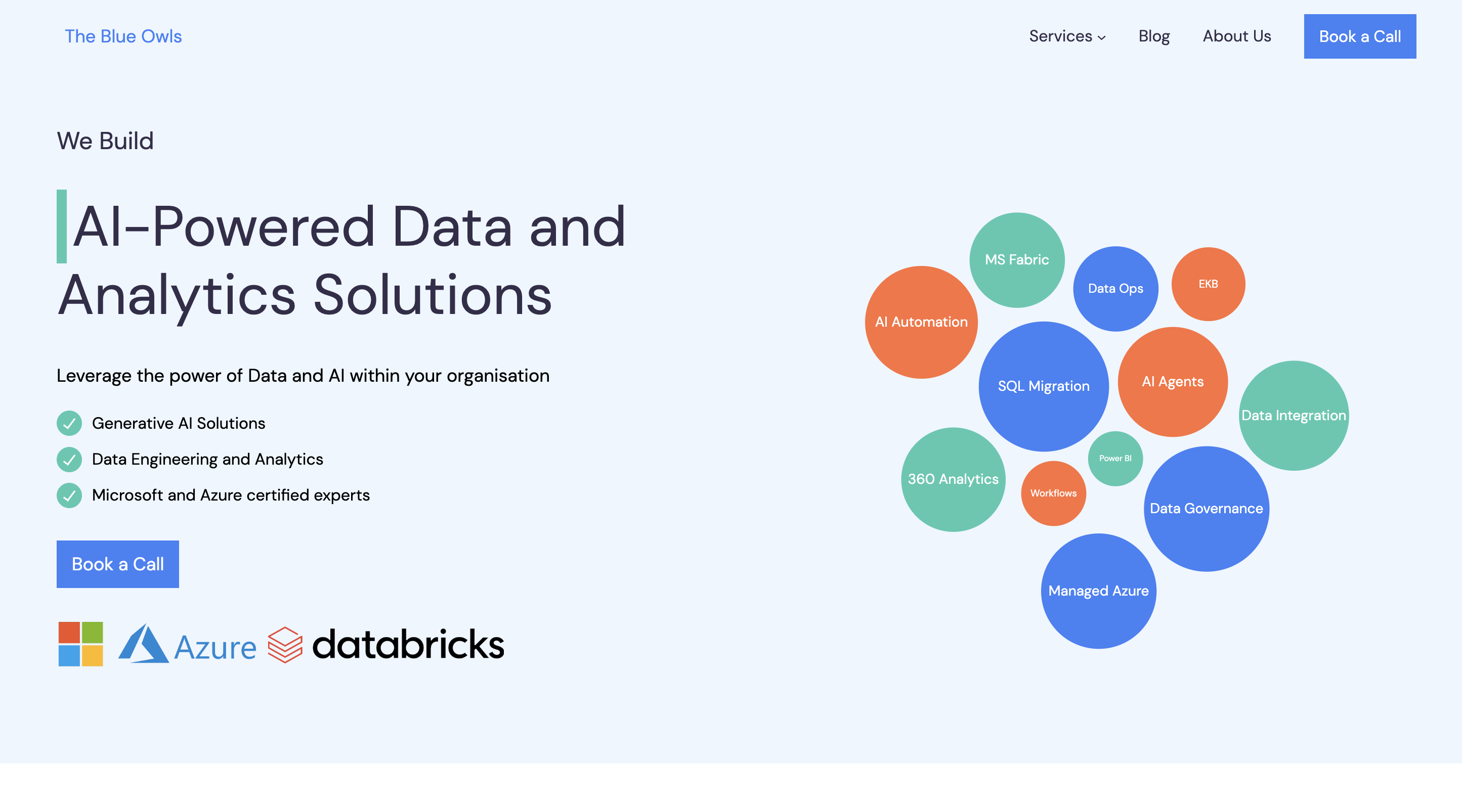

About the company

At TheBlueOwls, we are passionate about harnessing the power of data analytics and artificial intelligence to transform businesses and drive innovation. With a team of experts and cutting-edge technology, we help our clients unlock valuable insights from their data and leverage AI solutions to stay ahead in today's competitive landscape.

Our Founder

Our company was founded by Puran Ticku, an ex-Microsoft Architect with over 20+ years of experience in the field of data and digital health. Puran Ticku has a deep understanding of the potential of data analytics and AI and has successfully led transformative solutions for numerous organizations.

Our Expertise

We specialize in providing comprehensive data analytics services, helping businesses make data-driven decisions and uncover hidden patterns and trends. With our advanced AI capabilities, we enable our clients to automate processes, enhance productivity, and gain a competitive edge in their industries.

Our Approach

At TheBlueOwls, we believe that the key to successful data analytics and AI implementation lies in a holistic approach. We work closely with our clients to understand their unique challenges and goals, and tailor our solutions to meet their specific needs. Our team of skilled professionals utilizes state-of-the-art technology and industry best practices to deliver exceptional results.

Our Commitment

We are committed to delivering the highest level of quality and value to our clients. We strive for excellence in every project we undertake, ensuring that our solutions are not only effective, but also scalable and sustainable. With our deep domain expertise and customer-centric approach, we are dedicated to driving success for our clients and helping them achieve their business objectives.

Contact us today to learn more about how TheBlueOwls can empower your organization with data analytics and AI solutions that drive growth and innovation.

Jobs

3

About the company

RockED is the premier people development platform for the automotive industry, supporting the entire employee lifecycle from pre-hire and onboarding to upskilling and career transitions. With micro-learning content, gamified delivery, and real-time feedback, RockED is educating the automotive workforce and solving the industry's greatest business challenges.

The RockED Company Inc. is headquartered in Florida. Backed by top industry experts and investors, we’re a well-funded startup on an exciting growth journey. Our R&D team (Indian entity) is at the core of all product and technology innovation.

Jobs

2

About the company

Automate Accounts is a technology-driven company dedicated to building intelligent automation solutions that streamline business operations and boost efficiency. We leverage modern platforms and tools to help businesses transform their workflows with cutting-edge solutions.

Jobs

2

About the company

Peak Hire Solutions is a leading Recruitment Firm that provides our clients with innovative IT / Non-IT Recruitment Solutions. We pride ourselves on our creativity, quality, and professionalism. Join our team and be a part of shaping the future of Recruitment.

Jobs

226

About the company

Albert Invent is a cutting-edge R&D software company that’s built by scientists, for scientists. Their cloud-based platform unifies lab data, digitises workflows and uses AI/ML to help materials and chemical R&D teams invent faster and smarter. With thousands of researchers in 30+ countries already using the platform, Albert Invent is helping transform how chemistry-led companies go from idea to product.

What sets them apart: built specifically for chemistry and materials science (not generic SaaS), with deep integrations (ELN, LIMS, AI/ML) and enterprise-grade security and compliance.

Jobs

4