M M Financial Services Limited

https://mahindrafinance.comAbout

Connect with the team

Jobs at M M Financial Services Limited

No jobs found

Similar companies

About the company

To hire better and faster, companies need rich candidate data, smart software and sound human judgement.

Cutshort is using AI to combine all these 3 to offer a 10x talent sourcing solution that is faster, better and cheaper.

We have 3 AI-powered offerings

- Hire using our AI platform: Affordable annual subscriptions

- Get only sourcing: 3.5% of annual CTC when you hire

- Get full recruiting: 6.99% of annual CTC when you hire

Customers such as Fractal, Sprinto, Shiprocket, Highlevel, ThoughtWorks, Deepintent have built strong engineering teams with Cutshort.

Jobs

1

About the company

The Story

Founded in 2011, Poshmark started with a simple yet powerful idea in Manish Chandra's garage. Along with co-founders Tracy Sun, Gautam Golwala, and Chetan Pungaliya, Chandra envisioned a platform that would revolutionize how people buy and sell fashion. The inspiration came from seeing the potential of the iPhone 4 to create meaningful connections in the shopping experience.

What They Do

Poshmark is not just another e-commerce platform – it's a social marketplace that brings together shopping and community. Think of it as a place where social media meets shopping, allowing users to buy, sell, and discover fashion, home goods, and accessories. With over 80 million users , the platform has become a go-to destination for both casual sellers and entrepreneurial individuals looking to build their own digital boutiques.

Growth & Achievements

- Started as a fashion-only platform and successfully expanded into home goods and electronics

- Raised over $160 million in venture funding

- Achieved a successful IPO in January 2021

- Recently launched innovative features like AI-powered visual search and livestream shopping

- Built a vibrant community of millions of buyers and sellers across the country

Today, under CEO Manish Chandra's leadership, Poshmark continues to innovate in the social commerce space, blending technology with community to create a unique shopping experience. The platform's success story is a testament to how combining social connections with commerce can create a powerful marketplace that resonates with modern consumers.

Jobs

7

About the company

At Zobaze, we're not just developing apps; we're crafting the future of SMEs worldwide. Our quest to become the premier business utility app drives us to deliver revolutionary solutions like Zobaze POS and Restokeep. These tools don't just manage business—they propel it, enabling owners to monitor everything from sales to staff performance with unparalleled ease and efficiency.

With a remarkable footprint spanning 192 countries and over 2.5+ million downloads, our apps have already generated 140+ million receipts, evidencing our substantial global impact.

As a 100% bootstrapped company, our journey from inception to cash-positive operations exemplifies our dedication and resilience. We stand as a beacon of innovation and sustainability in the SME sector.

🤑 Funding

We are proud to be cash flow positive and have not yet tapped into VC funding, setting us apart from 99% of startups. This financial stability allows us to invest in our team's growth through a robust ESOP pool.

Securing funding will further accelerate our growth. Joining our team now offers a unique opportunity to create significant value, especially before our fundraising efforts take off.

⚠️ Before you apply

If you're looking for a standard 9-5 job, we are not a match. However, if you seek an exceptional learning curve, exposure to multiple verticals, and the opportunity to help establish processes that will propel our growth, we encourage you to apply. Our journey is dynamic, requiring flexibility and adaptability to changing needs.

Jobs

2

About the company

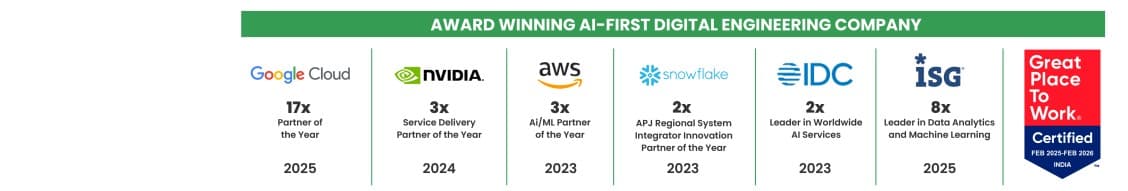

Quantiphi is an award-winning AI-first digital engineering company driven by the desire to reimagine and realize transformational opportunities at the heart of the business. Since its inception in 2013, Quantiphi has solved the toughest and most complex business problems by combining deep industry experience, disciplined cloud, and data-engineering practices, and cutting-edge artificial intelligence research to achieve accelerated and quantifiable business results.

Jobs

7

About the company

At PeopleX Ventures, we take great pride in our role as a recruiting partner, dedicated to fulfilling the unique staffing needs of our clients across levels for both technical and non-technical domains, as well as, hiring CXO and CXO -1 across functions and roles, where we ensure we take up only a limited number of roles so that we can deliver successful outcomes.

Our distinctive strength is derived from our exceptional freelance team members, some of whom possess over a decade of valuable experience in corporate and consulting positions, hiring for organizations such as Google, Meta, Flipkart, Intuit, Adobe, Microsoft, Walmart PLUS many early/late stage startups. We as a team carry varied strengths hiring across engineering, product, sales & marketing, finance, HR, etc across levels. Our clientele includes startup organizations (Pre-Series, Series A, B, C, D) and product companies. However, we continue to experiment with organizations we can support.

Jobs

30

About the company

Jobs

552

About the company

Jobs

6

About the company

GrowthArc is a technology consulting firm that helps growth-focused companies translate strategy into execution through an architecture-led approach. By combining the power of platforms, data, and AI, GrowthArc enables organizations to scale seamlessly while aligning technology initiatives with core business priorities.

At the heart of its work is the Business Technology Blueprint (BTB) framework — a proven methodology designed to simplify execution complexities and drive measurable outcomes. Built on deep industry, domain, and technology expertise, GrowthArc helps enterprises design scalable architectures and realize them with intelligent platforms, interconnected data, and integrated AI solutions.

Jobs

0

About the company

Jobs

1

About the company

Jobs

1