For companies hiring in India, choosing how they source and find talent is one of the most important decisions. Naukri Resdex, LinkedIn and Recruitment agencies are the most common offerings in the Indian market today.

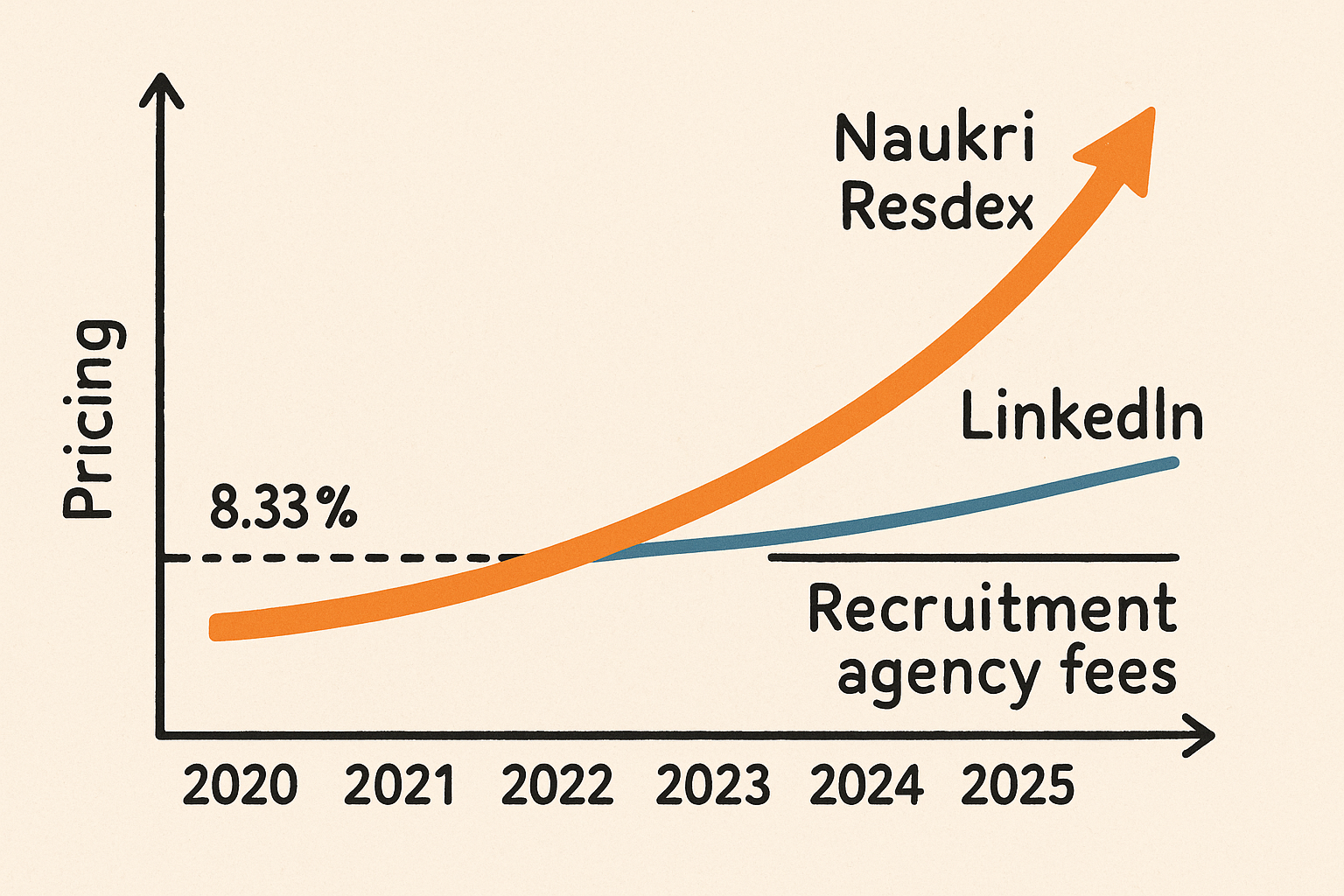

Let’s dive into the complex but fascinating world of India’s recruitment market – especially how Resdex, LinkedIn recruiters, and recruitment agencies stack up on pricing and long-term trends. Here’s what you need to know…

The Three Pillars: Resdex, LinkedIn & Recruitment Agencies

India’s recruitment industry stands on three giant pillars:

- Naukri Resdex: The go-to candidate database for in-house recruiters.

- LinkedIn Hiring Solutions: Powered by social mapping and direct hiring tools.

- Recruitment Agencies: Classic search partners working on success fees.

Each has distinct pricing models, advantages, and pain points. But pricing trends are shifting, reflecting India’s red-hot talent war and digital transformation.

Naukri Resdex Pricing: How Much Are You Paying Today?

Naukri Resdex is a subscription service offered by Naukri.com, giving recruiters database access to millions of resumes. If you’re a corporate recruiter or a startup founder, chances are high that you’ve evaluated or used Resdex at some point.

Current Pricing Models

- Subscription based – usually sold in packages (monthly, quarterly, or yearly).

- Credits or resume download limits – more credits mean higher cost.

- Additional features (like advanced search, AI recommendations, etc.) come at a premium.

As per several enterprise recruiters and market watchers,

- Base pricing for Naukri Resdex in 2025 starts around ₹55,000 for three months (entry plan),

- Mid-range plans can exceed ₹3 lakh annually depending on seat count and features.

- Enterprises typically pay anywhere from 50 Lakhs to 3 crores/year.

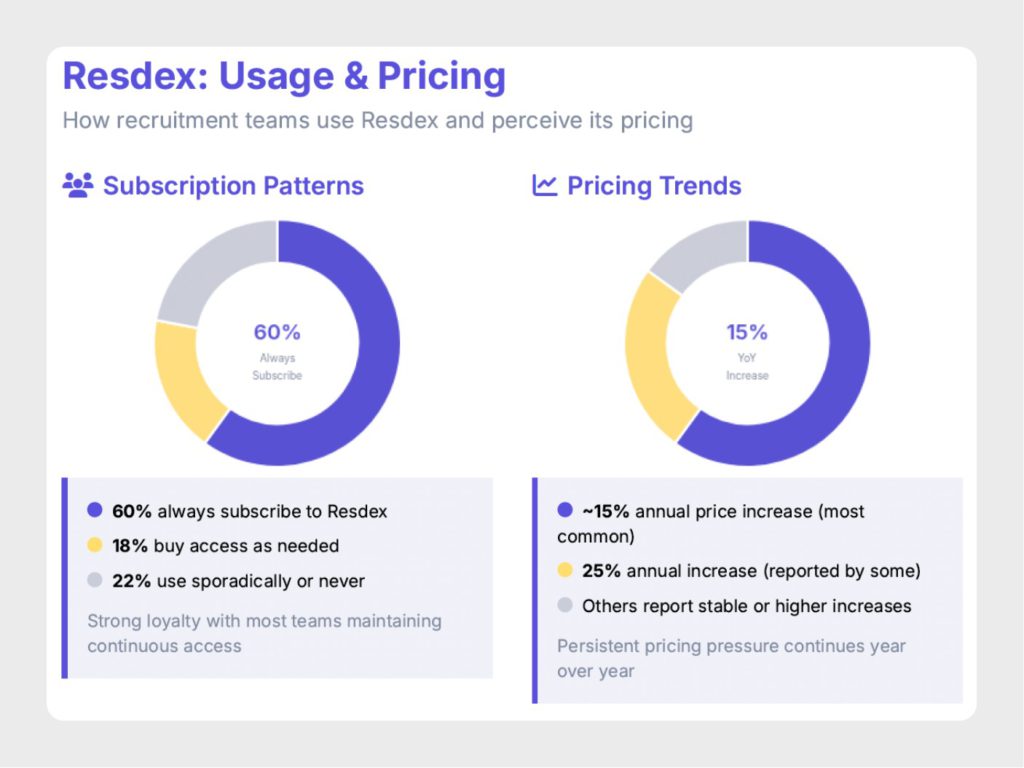

2025 Naukri Resdex Pricing Trend: The 15% Hike

Here’s where it gets interesting. We did a survey recently and many TA leaders reported a consistent 15% increase in Resdex pricing over the last 12-15 months.

Check out the complete survey report here

This aligns with India’s rising demand for premium digital hiring solutions. The good news? If you’re an early customer or have annual contracts, you might still have some leverage – but renewals are getting pricier fast.

What does this mean for you? If Resdex is a must-have in your toolkit, planning your budget for 2025 will need a closer look at ROI and alternative sourcing strategies.

What This Means For Recruiters

- Budget Creep: Costs rising faster than inflation means scrutinizing every renewal.

- Need for Negotiation: Many companies find discounts or bundled deals, but only by bargaining hard.

- Switching Incentives: High price increases are pushing some firms to explore LinkedIn or even revival of agency models.

In short, Resdex is still the default – but the value equation is shifting. What do you think: Should digital databases get this costly?

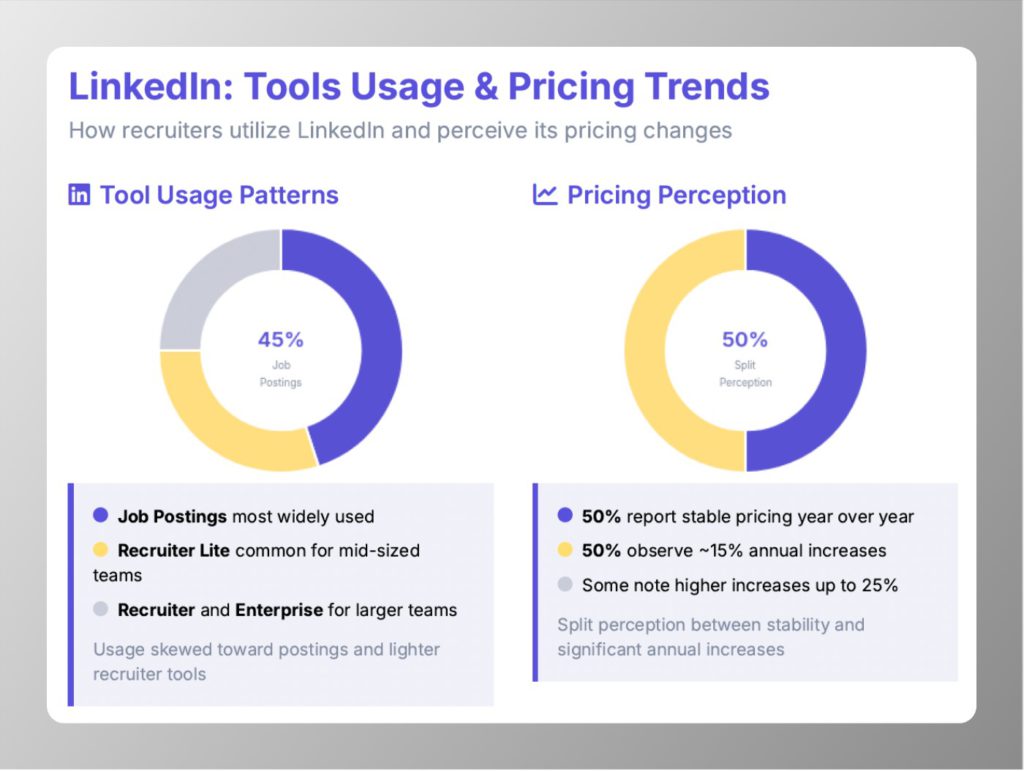

LinkedIn Hiring Solutions: Steady, But Not Static

If Naukri is the database king, LinkedIn offers “active + passive” talent – candidates who might not upload their CVs but stay open to recruiter messages.

LinkedIn Pricing Models

- Seat-based subscriptions (e.g., LinkedIn Recruiter Lite, LinkedIn Recruiter Corporate).

- Pricing by region and package level, often invoiced annually.

- Pay-per-click/post options for sponsored jobs.

In India, a LinkedIn Recruiter Lite seat runs roughly ₹8,000 to ₹9,200 per month, with full-feature Recruiter licenses exceeding ₹2 lakh/year. Exact pricing reflects team size and special deals.

2025 Trends: Subtle Price Movement

In our survey, compared to Resdex, LinkedIn is subtler with price hikes – but don’t be surprised if they slide in a 10-15% increase for larger enterprise deals or custom segments.

LinkedIn invests heavily in new features and machine learning, so incremental annual hikes are now common (see LinkedIn’s official insights on pricing strategies for more).

If you’re still optimizing personal or company presence, check our detailed guide: How to Optimize your LinkedIn Profile in 2025.

What’s the big picture? LinkedIn remains a ‘prestige’ product for talent teams, avoiding sudden price shocks but gradually inching rates upward – especially as India’s tech hiring boom continues.

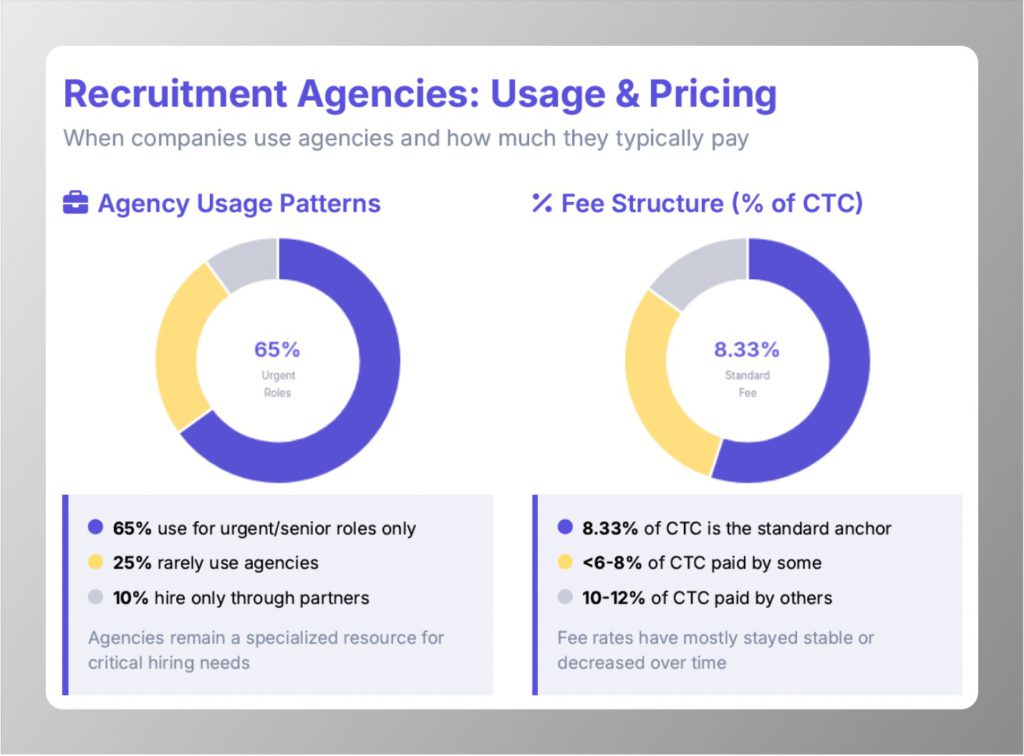

Recruitment Agency Pricing: The 8.33% “Standard”

The third major option in India recruitment market: agencies working on a “success fee” or placement charge. The model is old-school – but far from obsolete.

How It Works

- Typically 8.33% of annual CTC (Cost to Company), paid only upon a successful hire.

- Larger agencies may charge 10-12% or offer sliding fees for niche/senior roles.

- No upfront cost; agency earns only if candidate joins and stays during guarantee period.

As confirmed in our survey, this model has held steady for years.

While companies sometimes negotiate (especially for bulk or junior hiring), the 8.33% fee has proved surprisingly resilient – especially compared to SaaS-based models.

What’s Changed Over Time?

- Stability: Unlike digital tools, agency fees have barely budged in 5 years.

- Service Mix: More agencies now bundle ATS tools, assessments, or onboarding support – often at no extra cost.

- Specialization: Niche agencies (tech, product, or startup) may charge more, but mainstream roles stay close to the 8.33% line.

What do you think? Is stability better than rising SaaS costs, or do digital tools add enough value to justify their upward trajectory?

Decoding the Dynamics: Why Are Prices Changing?

This isn’t just a story of cost – it’s a reflection of the recruitment market’s digital evolution in India. Three trends are driving the 15% bump for Resdex and the gentler uptick in LinkedIn pricing:

- Market Consolidation: Large players (Naukri, LinkedIn) wield more pricing power as competition thins and the war for talent intensifies.

- AI Integration: Tools promising smarter search and filtering (like ATS+AI) lead to higher development and subscription costs – those investments get passed down to buyers (see Brandwell’s analysis of efficiency versus cost).

According to recent Naukri market reports, India’s corporate hiring volume grew 22% year-on-year in 2024. As a result, demand for premium database access is “at an all-time high.” Recruiters report database access forming nearly 30% of total hiring budgets in top metros like Bangalore and Mumbai.

Comparison Table: Cost, Reach & Value

| Platform | Model | Typical Cost | Value Proposition |

|---|---|---|---|

| Naukri Resdex | Subscription | ₹55,000 (3 mo entry) to ₹3 lakh+ p.a. | India’s broadest white-collar resume database |

| Subscription / Per job | ₹8k-₹9.2k/mo per seat (Lite); ₹2 lakh+ p.a. (Full) | Active and passive search; social mapping | |

| Recruitment Agency | Success fee | 8.33% of annual CTC (standard) | Expert search + Only pay on hire |

Takeaway – companies are looking for more viable alternatives in 2025

Recruitment market in india shows the classic signs of a large market with clear category leaders, but customers not being happy with them.

- Resdex and LinkedIn continue to increase prices by ~15% (and sometimes 25%) every year.

- Agency fees have remained more stable at 8.33% of CTC, though usage is highly specialized (mostly urgent or senior hires).

- AI is starting to provide productivity gains — but most teams are yet to quantify this.

In short: pricing pressure is real, satisfaction is low, and the search for better ROI is on.

New offerings coming now as alternatives

Here’s a radical idea: Will database subscriptions become so expensive that “pay-on-success” models return to dominance? Already, some hiring managers are revisiting agency partnerships not just for lower upfront cost, but for service and accountability. Others wonder if in-house teams should boost referral drives to offset rising SaaS pricing.

The good news: it’s already happening.

Cutshort has launched Sourcing-only service which offers high quality plug-and-play sourcing at just 3.5% success fees.

https://cutshort.ai/sourcing-assistant

https://cutshort.ai/sourcing-assistant

Frequently Asked Questions: Naukri Resdex Pricing & India Recruitment Market

- 1. What is included in the Naukri Resdex subscription?

- Subscription typically includes database access, resume downloads (within credit limits), advanced search, and sometimes AI-driven filters. Higher-tier plans offer more users and additional analytics features.

- 2. How much has Naukri Resdex pricing increased recently?

- Most recruiters report a 15% hike in 2024–2025 compared to last year. These cost changes are market-wide and reflect growing demand for database access.

- 3. How does LinkedIn’s pricing compare with Resdex?

- LinkedIn Recruiter Lite is cheaper per month but offers less “direct” access to CVs. Full LinkedIn Recruiter licenses are similar to high-end Resdex plans, especially for larger HR teams.

- 4. Is recruitment agency pricing negotiable in India?

- Agencies typically charge 8.33% of annual CTC, which has stayed stable for years. However, large or long-term clients sometimes negotiate bulk discounts or lower rates for junior roles.

- 5. Which is more cost-effective: database access or paying agency success fees?

- It depends on your hiring volume and specialization. Frequent or bulk hiring favors subscription models; rare or highly-niche roles may be cheaper via agencies.

- 6. Are there hidden costs in Naukri or LinkedIn subscriptions?

- Extra fees apply for add-ons like additional recruiter seats, analytics, or higher daily download limits. Always clarify contract terms before signing.

- 7. How can Indian recruiters optimize costs given the price hikes?

- Optimize by rotating platforms, negotiating renewals, using analytics to track effectiveness, and balancing digital access with selective agency partnerships.

- 8. What are some alternatives to Naukri Resdex and LinkedIn?

- Alternatives include specialist job boards, referral drives, and platforms like Cutshort.io that offer direct, skill-tested access to candidates. Explore hybrid solutions for more resilient hiring pipelines.

Conclusion: The Rule of Three for Smart Hiring in 2025

To sum up, here are the three enduring truths for India’s recruiters in 2025:

- Pricing is dynamic: Naukri Resdex and LinkedIn will keep adjusting rates – tracking ROI is now essential.

- Agency models remain stable, and might even stage a comeback as SaaS fees rise.

- Mixing models – digital, social, and agency – gives you flexibility and control over both cost and talent quality.

India’s recruitment market is entering a new chapter. Will you adapt or get left behind? If you want to go deeper, our guide to AI-powered resume scorers is a great next read. Let’s build the future of hiring, one smart budget decision at a time.